MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

During the December 11, 2023 City Council Meeting, the City of Fairburn Mayor & City Council approved an expansion of the City’s Homestead Exemption Program. The Homestead Exemption Program reduces the taxable value of citizens homes.

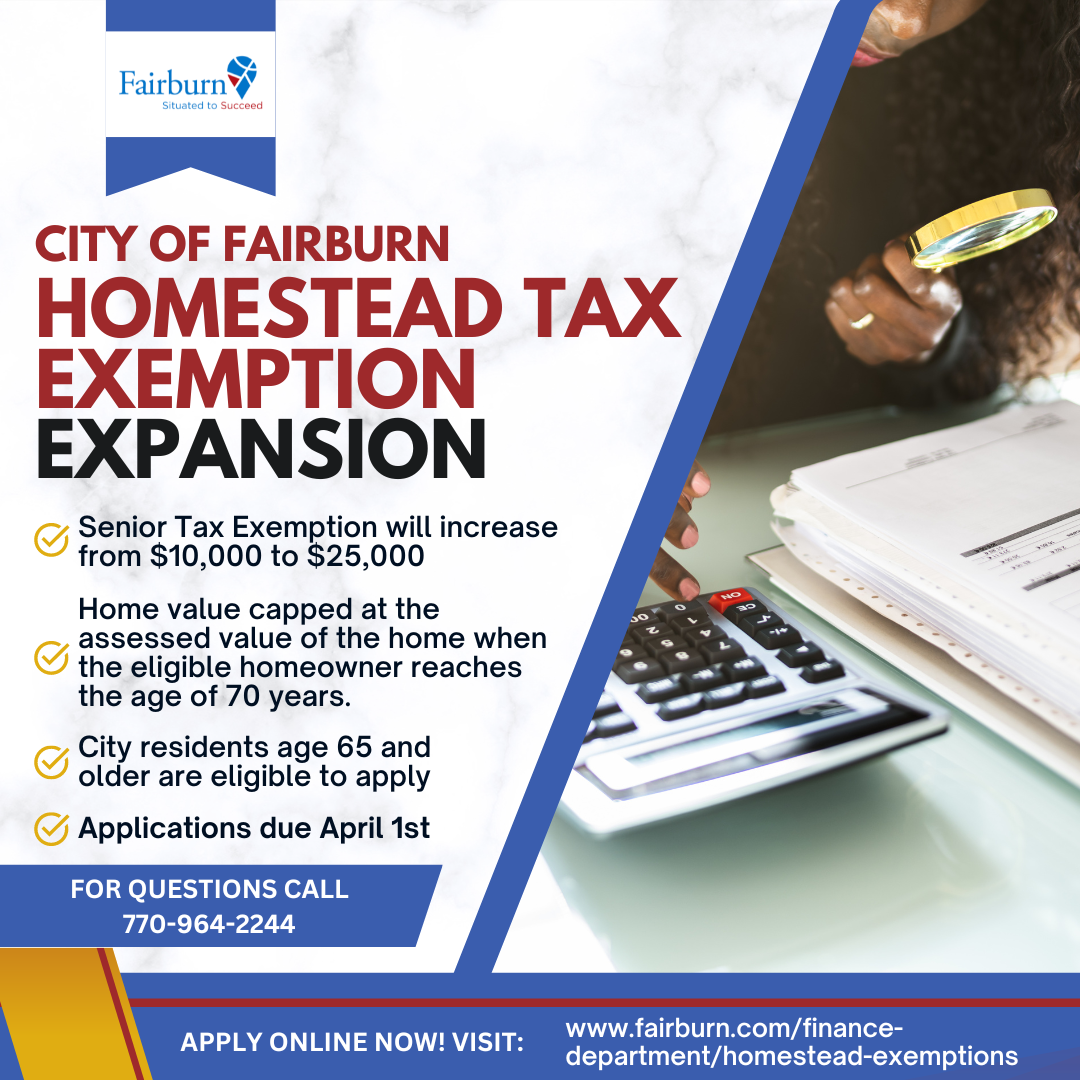

With this extension, the City aims to provide relief to City of Fairburn residents 65 years of age or older by increasing the current homestead exemption from $10,000 to $25,000 and by capping the value of a homestead for taxing purposes at the assessed value of the home when the eligible homeowner reaches the age of 70.

“As elected officials, one of our most basic duties is to protect our residents, especially our older adults,” said Mayor Mario B. Avery. “This legislation extension aims to safeguard and offer financial relief to our most vulnerable residents. We strive to extend help for those who may be at risk of their property going to tax sale. Stabilizing our homeowners is essential to growing this great city and we are grateful for approval of this initiative.”

This annual exemption is available for each residential homeowner of the City who is 65 years of age or older by April 1st of the applicable calendar year, or who is disabled. Those residents who are unmarried widows or widowers of a peace officer, firefighter or military service member who was killed in the line of duty or in combat, will receive an exemption from all ad valorem taxes in the amount of $50,000.00 of the assessed value on a home owned and occupied by such resident as their primary residence.

“This extension says we care about our seniors and making the City of Fairburn affordable for all,” says City Administrator Tony M. Phillips “This will give seniors the opportunity to stay in the City of Fairburn. It is the right thing to do, not just for our seniors. The benefit really extends to all of our families.”

The City of Fairburn accepts Homestead Exemption applications year-round; however, to grant a homestead exemption for the current tax year, we must receive your application no later than the deadline of April 1st. You may qualify for a homestead exemption (Senior Exemptions Do Not Apply Automatically) from City of Fairburn Property Tax.

Qualified applicants should complete the Homestead Exemption Application. Once forms are completed, they are to be submitted in person at Fairburn City Hall. Residents are encouraged to include all the appropriate documentation to ensure timely processing of their application.

To qualify you must:

- Be 65 years of age or older by April 1st of this year

- Live in the home as your primary residence

For more information and to download the Homestead Exemptions forms, visit https://www.fairburn.com/finance-department/homestead-exemptions. The forms on the website are screen fillable, however, you must print the forms to sign and notarize. The forms may not be submitted electronically.

For questions, please call City Hall at 770-964-2244.