Small Business Grant Program

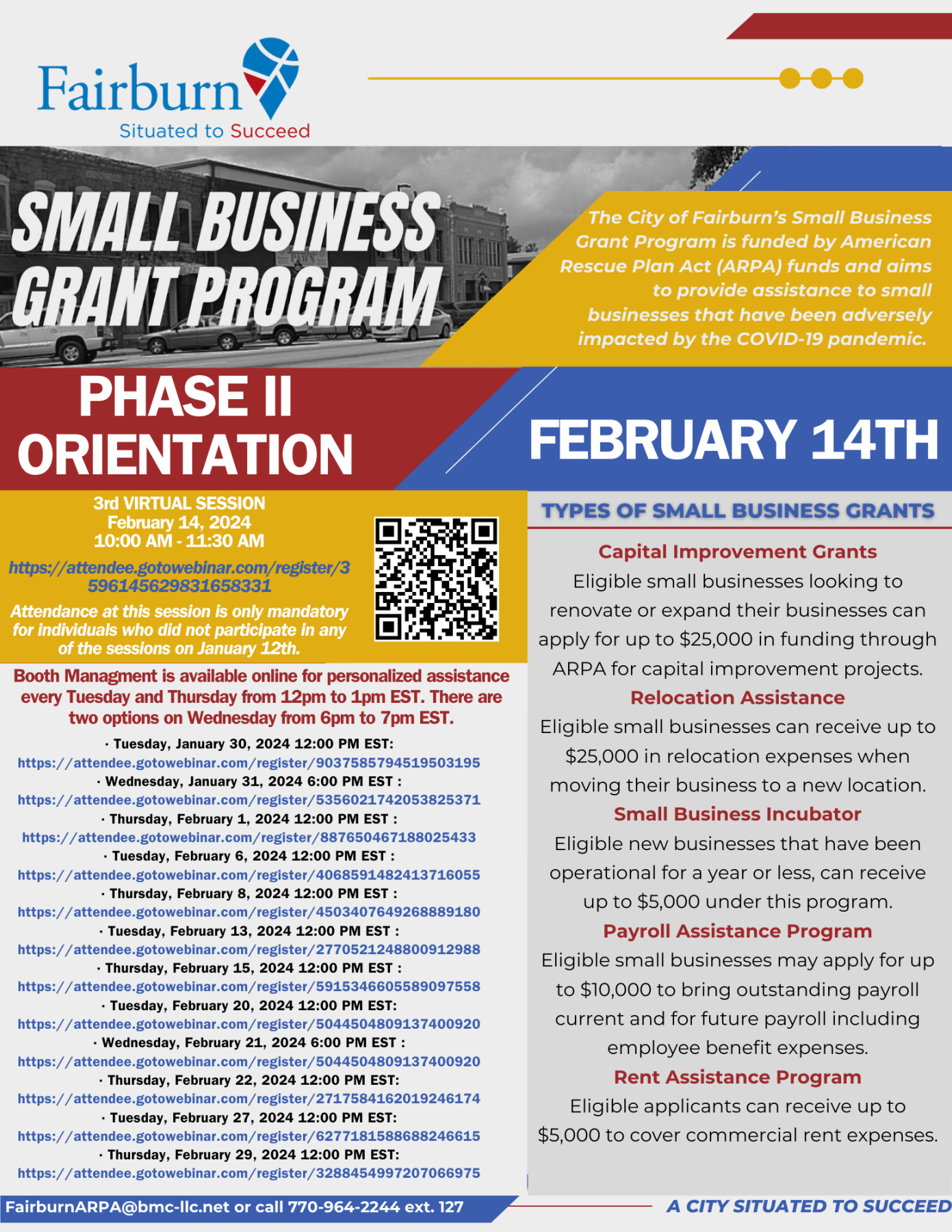

SMALL BUSINESS GRANT PROGRAM - PHASE II ORIENTATION

PHASE II ORIENTATION - 3rd Virtual Session - Wednesday, February 14, 2024 10:00 AM EST: https://attendee.gotowebinar.com/register/3596145629831658331

· Tuesday, January 30, 2024 12:00 PM EST: https://attendee.gotowebinar.com/register/9037585794519503195

· Wednesday, January 31, 2024 6:00 PM EST : https://attendee.gotowebinar.com/register/5356021742053825371

· Thursday, February 1, 2024 12:00 PM EST : https://attendee.gotowebinar.com/register/887650467188025433

· Tuesday, February 6, 2024 12:00 PM EST : https://attendee.gotowebinar.com/register/4068591482413716055

· Thursday, February 8, 2024 12:00 PM EST : https://attendee.gotowebinar.com/register/4503407649268889180

· Tuesday, February 13, 2024 12:00 PM EST : https://attendee.gotowebinar.com/register/2770521248800912988

· Thursday, February 15, 2024 12:00 PM EST : https://attendee.gotowebinar.com/register/5915346605589097558

· Tuesday, February 20, 2024 12:00 PM EST: https://attendee.gotowebinar.com/register/5044504809137400920

· Wednesday, February 21, 2024 6:00 PM EST : https://attendee.gotowebinar.com/register/5044504809137400920

· Thursday, February 22, 2024 12:00 PM EST: https://attendee.gotowebinar.com/register/2717584162019246174

· Tuesday, February 27, 2024 12:00 PM EST: https://attendee.gotowebinar.com/register/6277181588688246615

· Thursday, February 29, 2024 12:00 PM EST: https://attendee.gotowebinar.com/register/3288454997207066975

What is the Small Business Grant Program?

The City of Fairburn, GA has allocated $300,000 from its American Rescue Plan Act (ARPA) funds to the Small Business Grant Program. The program is aimed at providing assistance to small businesses that have been adversely affected by the COVID-19 pandemic. These businesses have been facing unique challenges and experiencing economic difficulties, and this program seeks to address their specific needs.

What type of grant can I apply for?

- Capital Improvement Grants - Small businesses looking to renovate or expand their businesses can apply for up to $25,000 in funding through ARPA for capital improvement projects. To qualify, applicants must provide a project timeline that shows the completion of the project before September 30, 2024, as well as an estimate or quote.

- Relocation Assistance – Small businesses can receive up to $25,000 in relocation expenses when moving their business to a new location. To be eligible, they must provide a rental agreement for the new space and confirm that they are not behind on rent at their current location. The relocation must occur by September 30, 2024.

- Small Business Incubator – New businesses that have been operational for a year or less, can receive up to $5,000 under this program. The grant funds can be used for general operating expenses such as software, advertising, marketing, and other similar costs. However, it cannot be used for rent or payroll expenses. Please refer to the Payroll and Rent Assistance programs. To be eligible for this program, small businesses must be operational at the time of application. Grant funds must be spent within 60 days of the grant award. The project must be completed by June 30, 2024.

- Payroll Assistance Program – Small businesses may apply for up to $10,000 to bring outstanding payroll current and for future payroll including employee benefit expenses. Grant funds must be spent within 60 days of the grant award not to extend beyond June 30, 2024.

- Rent Assistance Program – Applicants can receive up to $5,000 to cover commercial rent expenses. The grant amount must match or be less than the total rent obligation at the time of application submission. Landlords must provide documentation that the grant funds will pay overdue rent and bring it current. Grant funds must be spent within 60 days of the grant award not to extend beyond June 30, 2024.

How long will I have to spend the money?

The period of performance for completion of the grant is based on the program:

Award date to September 30, 2024:

- Capital Improvement

- Relocation

Award date to within 60 days of award of the award not to extend beyond June 30, 2024:

- Small Business Incubator

- Payroll Assistance

- Rent Assistance

Who may apply for the Small Business Grant Program funding?

Small businesses within City boundaries meeting program requirements for one of the programs may apply. Applicants MUST:

- Clearly demonstrate a revenue loss due to the negative economic impact of COVID-19 on their business.

- Have annual revenues of less than $5 million.

- Be in “Good Standing” or “Active” with the State of Georgia and the City of Fairburn.

- Have between 1 and 50 employees.

- Be in operation as of the date of the application.

- Be a for-profit business.

- National franchises and chains will be considered on a case-by-case basis.

- City of Fairburn property taxes and other City bills/obligations are not eligible.

- City elected officials are not eligible.

How many small business programs can I apply for?

Applicants may only apply for one small business grant program. If multiple programs are selected, the applicant will be asked to choose one, which may cause delays.

What do I need to submit?

- Completed application submitted online at City of Fairburn Small Business Program Application

- In the online application, the following general documentation to prove eligibility must be uploaded:

- Two most recent tax returns

- Most Recent Income Statement

- Two most recent bank statements

- Certify to maintain funded project(s) within the City of Fairburn for a minimum of two (2) years

- Certify that they will maintain a business website with links to the City of Fairburn’s website for news and information

How do I apply?

Please review the Small Business Grant Program guidelines, including eligibility requirements and submit a complete application with the supporting documentation.

Applications will be accepted as follows:

- Online at Click Link: City of Fairburn Small Business Program Application.

- Hardcopy by email to fairburnARPA@bmc-llc.net or deliver to City Hall by

application due date. Click the link for the PDF fillable version Fillable Application - City of Fairburn Small Business Grant Program.pdf- City of Fairburn

- City Hall

- 56 Malone Street SW

- Fairburn, GA 30213

- Attention: Sylvia Abernathy- Small Business Grants Program

- By telephone with an appointment. Send a request for an appointment to fairburnarpa@bmc-llc.net.

Mailed applications will NOT be accepted.

Applications are accepted on a first come, first served basis and are available until Wednesday, February 29th.

Applications will be accepted and reviewed as they are submitted (e.g., on a first-come, first-served basis).

The City encourages applicants to submit the applications as soon as possible due to the limited funding.

The City is providing training and technical assistance detailed below during the application period.

Training Material: Small Business Grant Program Application Informational Session_Final.pptx

Training Recording Link: Small Business Grant Program Informational Session Recording

Project Email Group. If you have questions, email the application review team at FairburnARPA@bmc-llc.net. You will receive a response to your question within one business day. You can also request a conference call.

What is the Small Business Grant Program application review process?

The City will administer the program under the guidance and direction of the City Administrator.

Applications will be accepted and reviewed on a first-come, first-served basis. Submission of an incomplete or inaccurate application may result in a delay in approval or denial of funds.

All award and non-award notifications will be sent the first week of December.

The determination as to whether the application provides sufficient proof that the business experienced a negative economic impact due to COVID-19 or responds to the negative economic of COVID-19 shall be determined by the City in its sole judgment and is not appealable.

Applicants will be notified, in writing, of the City’s decision regarding the application and funding amount (if applicable).

What are my responsibilities after the award?

You will receive a Small Business Grant Program Grant Closeout Survey 60 days (about 2 months) after the grant period ends. Completion of this survey is MANDATORY.